Some people are so obsessed with timing the pico bottom, that they miss the opportunity only to FOMO back in later at higher or break-even prices.

For investors with a long time horizon, creating a mental framework for your asset class of choice to estimate fair value can prove to be very valuable. For better or for worse, all your favourite shitcoins for the vast majority still follow Bitcoin (aside from ETH). So for the purpose of this article we’ll focus on BTC only. Both to satisfy my own curiosity as well as to create a high level investment framework for PHD Capital, I wanted to map out different models used to time the market and how to find fair value for such an asset class. The models & signals described in this article can fit into different categories:

On-Chain Analysis (which is historically more accurate for bottoms, than tops)

Technical Analysis

Macro Indicators

Sentiment Driven Signals

Here more than ever the expression “All models are wrong, but some are useful” should be kept in the back of your mind. Don’t forget people got REKT levering up based on Plan B’s Stock-to-Flow’s model that was promising 6-figure BTC by end of 2021 or longing based on on-chain Hopium in 2018.

Caution this is a very long article, link to TLDR here.

On-Chain Analysis

Since we’re transacting on a blockchain, we can see how much BTC is on exchanges and how much is in cold storage. We can then do all kinds of analysis on the true bitcoiners who don’t keep their coins on exchanges and ask questions such as:

How long have they held their coins without moving?

Is there a statistical likelihood after x days of cold storage where they’re less likely to sell?

Can we divide them into cohorts? And then what is their respective cost basis?

Well, you get the idea.

While on-chain analysis has historically been more accurate in calling bottoms than tops, let’s not forget that a lot of on-chain analysts were bullish in 2018 before the final capitulation. At the same time $7000 was great value taken over a couple years. So always be mindful of your investing time horizon.

There are additional reasons why on-chain analysis today could be less accurate in finding bottoms than it was in previous cycles. Willy Woo, by many called the father of on-chain analysis, writes about the sea change in spot vs. futures that he first observed in February.

Obviously on-chain analysis focuses on spot markets, so therefore if the futures markets become more dominant, the signal on-chain analysis provides will be weaker.

And then more recently Willy posts another chart that looks at price response to spot vs. futures. This shows that this whole bearmarket has largely been futures driven. So in turn you could make the argument that therefore history doesn’t need to repeat itself, especially in the modern era with futures hedging available that’s not picked up on-chain.

So with these notes of caution, here’s the different On-Chain bottom models that I’m looking at:

Mayer Multiple

The Mayer Multiple is calculated by dividing the Bitcoin Price by the 200 day moving average of the price. The Mayer Multiple highlights when Bitcoin is overbought or oversold in the context of longer time frames. It’s worth noting as the market becomes larger and less volatile, the peaks are becoming less exaggerated.

For reference: during the recent capitulation mid June to 17k the Mayer Multiple was more oversold than during 2018 capitulation.

MVRV Z-score

The basic formula for the MVRV Z-score simply subtracts the realized value of Bitcoin from its market value, and divides that total by the standard deviation.

Currently BTC is almost as undervalued as during the 2015 and 2018 bearmarket, but still not quite there.

BTC is below Realised Price

Realised Cap is value of all coins in circulation at the price they last moved, in other words an approximation of what the entire market paid for their coins. In this chart Realised Cap is mapped to the price domain by dividing by the total coin supply.

Currently BTC is below it’s realised price, showing it’s cheap relative to what the market paid for their coins.

The realised Price currently sits at $21k.

NVT Ratio

NVT Ratio (Network Value to Transactions Ratio) is similar to the PE Ratio used in equity markets.

When Bitcoin`s NVT is high, it indicates that its network valuation is outstripping the value being transmitted on its payment network, this can happen when the network is in high growth and investors are valuing it as a high return investment, or alternatively when the price is in an unsustainable bubble.

Bitcoin`s NVT is calculated by dividing the Network Value (market cap) by the USD volume transmitted through the blockchain daily. Note this equivalent of the bitcoin token supply divided by the daily BTC value transmitted through the blockchain, NVT is technically inverse monetary velocity.

In the chart below, the NVT line is smoothed with a 14 day moving average.

Currently the NVT is signaling a buy.

If you’re curious how you can use the NVT in a trading environment, this is a good read.

RVT Ratio

RVT is short for "Realised Value to Transaction Volume ratio" and as such is a derivative of MVRV Ratio. Where MVRV is a ratio of the market cap to realised cap (that is the the total value the market paid for their coins), RVT uses transaction volume. Since transaction volume tracks market cap to a very high correlation the results a similar. RVT creates a useful signal for macro market tops and bottoms and also can be used to locate what phase the market is in between these two transition points.

RVT is currently at the bottom of the range showing that we’re close to the botttom.

Puell Multiple

The Puell Multiple is a market metric for estimating the level of sell pressure in the market coming from miners. Historically, mining revenue primarily consisted of block subsidies awarded to a miner for finding a block. The USD value of that subsidy changes on a daily basis as the price of bitcoin changes. Traders found it useful to consider the value of the block subsidy to determine what sorts of pressures miners faced to sell these rewards to continue operations, since forced sellers in a market tend to bring down price.

Puell Multiple is in buy territory but still move to room lower in comparison to previous bear markets.

Word of caution for this one: we’re in a transition period where miners sometimes prefer to hodl their coins and take out loans etc, meanwhile the sell pressure from exchanges or GBTC for example could be bigger than miners.

Delta Cap - BTC $13.7K

The Realised Cap minus Average Cap. Market Cap has historically touched Delta Cap at market bottoms. The Delta Cap currently sits at $13,720.

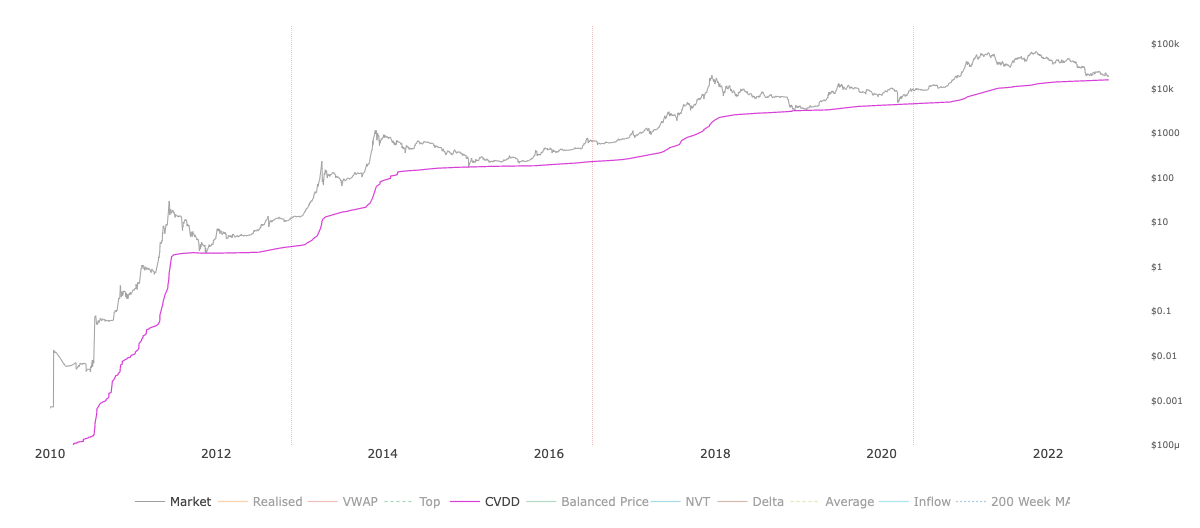

CVDD

CVDD (Cumulative Value Days Destroyed) has historically picked the bottom of the market. When coins pass from old investors to new investors, the transaction carries a USD value and also destroys an amount of HODL time by the previous holder. CVDD is the cumulative sum of this value-time destruction as a ratio to the age of the market and divided by 6 million as a calibration factor.

The CVDD currently sits at $15.600.

Short term holders cost basis below Long term holder cost basis

Historically bottoms seem to coincide with short term holders having a lower cost basis than long term holders. In 2015 a final capitulation happened in this area, and in 2019 it marked the bottom.

In the recent weeks we finally saw the short term holder realised price cross over with the long term holder realised price.

According to this metric we’re in bottom territory.

Miner Capitulation

As noted by On-Chain Analyst Will Clemente: Bitcoin's hash ribbons have recently flashed a buy signal for the first time since August 2021, marking the end of a 2+ month-long period of miner capitulation and deep pressure on miner's margins.

But more bad news, there is some theories that we might see a second miner capitulation:

2. Technical Analysis

Stablecoin marketcap/Total crypto marketcap

If we divide the biggest stablecoins marketcap by the total crypto marketcap, an interesting pattern appears:

A channel where a bounce off the top of the trendline marks historic bottoms. Whereas a bounce off the bottom trendline marks tops as this indicates a low % of stablecoins deployed (implying everyone is allocated to crypto).

While this marked the bottom on the June capitulation event, it’s currently tracking sideways.

200 Week Moving Average

Historically buying BTC at or below the 200 week MA has offered generational opportunities for the long term investor.

Will this time be different?

1D Crossover of the 50 & 200 EMA

If you would have swung for the fences every time there was a bullish crossover of the 50 & 200 Exponential Moving Average (EMA), you would have done pretty well.

Historically it wasn’t great at picking the generational bottom, and there was some downside involved for black swan events (~60%). But if you use it as a way to pick long term spot entries with minimal downside it did its job 80% of the time.

Bollinger Bands Oversold Signal on the 3D BTC Chart

Here’s one that you probably haven’t heard of:

The indicator is called TDI - Goldminds, by Jdonovan on TradingView.

The generational bottom entry is when the following criteria are satisfied:

BTC is oversold and therefore the MA’s (green & red) moves outside the lower bollinger band (blue lines)

This needs to occur below 30 on the indicator y-axis (the 1st gray dashed line)

Slow MA (green) passes over the fast MA (red)

Max drawdown if waiting for candle confirmation were 12% and 5% respectively. Keen observers will find that it also provides pretty accurate local top signals.

MarketCipher B on a 3D or Weekly chart

The marketcipher indicator suite has quite a few bells and whistles. It is made famous by its creator and leverage trader, Cryptoface. During the bullrun he would livestream his high leverage trades. Here’s an instance of a live $15m leverage position with $810k in unrealised profits:

The following image shows the free version of Marketcipher B (VuManChu Cipher B + Divergences on TradingView), I’ve modified to hide a lot of the indicators that are irrelevant for this signal.

Looking at either a 3D or Weekly Chart Bitcoin chart with Heikin Ashi candles the bottom signals are characterized by:

Moneyflow (in red & green) needs to be in oversold (red) territory.

Green dot denoting a buy signal.

VWAP (in yellow) crossing the zero line.

Bullish divergence in Momentum waves (blue) is the cherry on top.

Price Action - Break in Market Structure

The trend is your fren, until it’s not.

Price action trading is simple in theory, difficult in practice. To identify your high timeframe bias you would want to look on the weekly timeframe and establish if it’s an uptrend or downtrend.

TIMING THE TOP:

the trend changes from the uptrend to the downtrend

You would can see either a Lower High or a Lower Low first, you’d then change bias and move out of your position. While not perfect in timing the top, you would have avoided most of the bearmarket so far.

TIMING THE GENERATIONAL BOTTOM:

A change from downtrend to uptrend

So a Lower High and/or a Higher High.

While not always perfect in timing the pico bottom on higher timeframes such as the 3D or the Weekly, it definitely helps to create a risk management framework that helps protect your downside.

DXY Topping

With currently the Dollar Milkshake Theory playing out, we would ideally like to see a top formation in the dollar strength (DXY) before moving back into risk assets.

Interesting to note that all 3 tops in Bitcoin roughly coincided with bottoms in the DXY.

3. Macro Indicators

Before the FED Pivots, the market since it is forward looking will sniff it out and move up before the actual pivot is there.

So since we’re all waiting for the Powell Pivot, for that to happen some of these boxes need to be ticked:

Inflation comes down by forward looking metrics

Inflation comes down by backward looking metrics (CPI & PPI)

Index for liquidity as determined by the FED trending up (Tradingview indicator here)

Unemployment rates up (as the FED is trying to induce demand destruction via a recession)

Financial Stability is at risk with bond liquidity drying up and trading like shitcoins.

4. Sentiment & Non-Technical Signals

People leaving, Crypto Twitter is a ghost town, discords grow silent.

Memoirs of why the space is bad

Case in Point: Galois Capital recent medium post

Joke & scam projects give up, ambitious timelines reset and founders walk away.

The mainstream media gloats about how “crypto is dead” and about who stupid and greedy plebs were who attained short-lived wealth investing in crypto

Coinbase / Binance / FTX / Crypto.com no longer in top app downloads

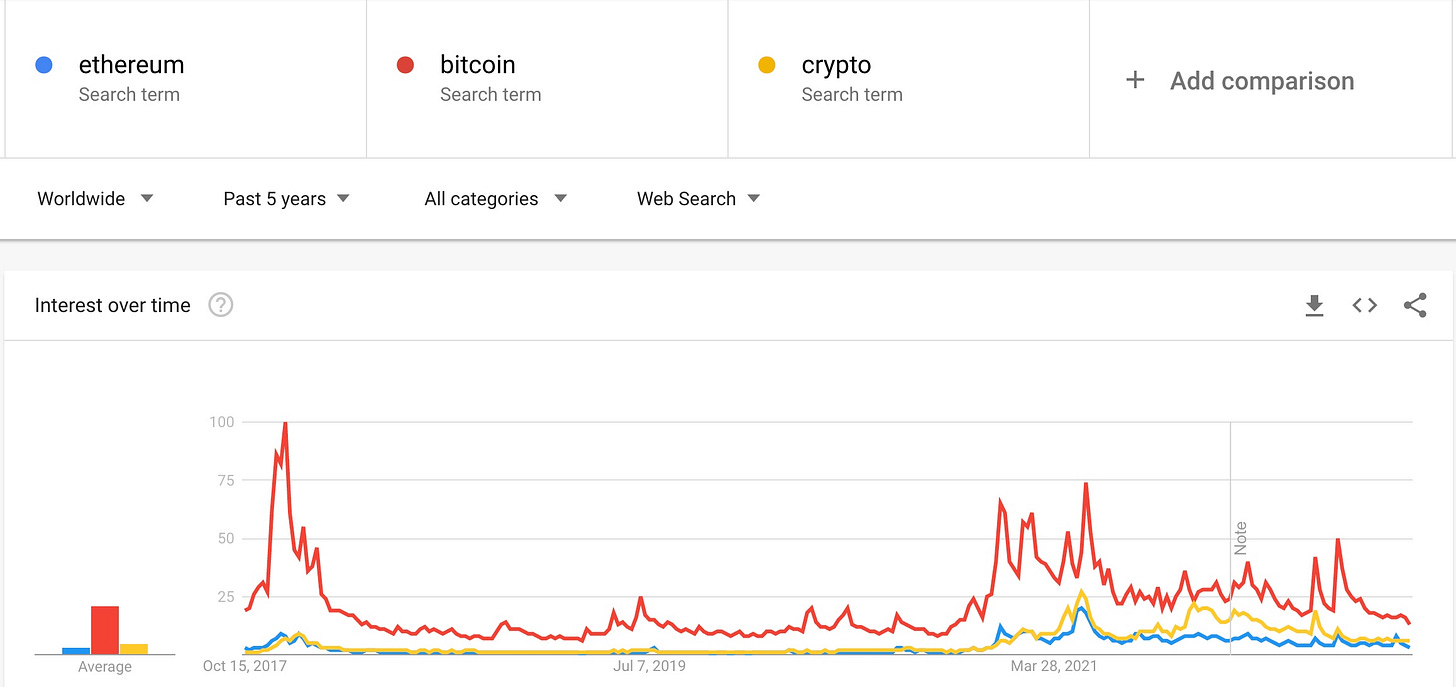

Google searches for BTC, ETH & Crypto back to all time lows (almost, not quite there yet)

General capitulation: Forced sellers: Cascade effects: 3AC, LFG, Celsius, etc

NFTs become illiquid

Cathie Wood down so bad she’s sending seething letters to the FED

Jim Cramer turning perma bearish on a high time frame and urges you to sell all your assets

Summary

Now that we’ve gone through a whole range of different models and indicators, let’s see which of the bottom signals have been checked off:

Onchain Bottom Signals: 83%

MVRV Z-score(still room to go a little lower)Below On-chain cost basis ratioShort-term holder cost basis falls below long-term holder cost basis.

Technical Analysis Bottom Signals: 50%

**Macro Indicators: 20%

Forward looking inflation indicators trending down

Sentiment & Non-Technical Bottom Signals: 90%

Has yet to happen:

Onchain Signals:

TA signals:

**Macro Indicators:

POWELL PIVOT

Inflation (CPI & PPI) coming down

Unemployment rates up

Index for liquidity trending up (indicator here)

Financial Stability is at risk (we’re close)

Sentiment:

Jim Cramer turning perma bearish on a high time frame and urges you to sell all your assets (the ultimate long-your-longs, max bidding signal)

**Since the market is forward looking, it will try to frontrun the pivot. So if you’re waiting for 100% of macro indicators to be bullish, you will most certainly miss the pico bottom. Do you want to pay for confirmation, is the question you have to ask yourself?

You have to ask yourself the question: “are you an optimist or a pessimist?”

If you’re an optimist you believe that while we are living through historic macroeconomic conditions, at the end of this there will be some form of a market left to sell your Bitcoin on.

If you’re a pessimist, you don’t believe there will be a market when the system goes bust and you should be buying guns, bullets and canned food instead of trying to time the bottom of bitcoin.

So if you’re an optimist Bitcoin is approaching fair value by most metrics. Below $20k you should be bullish if you’re a long term investor.

There’s no guarantee we will see a similar capitulation as in the past.

Is this time really different? Will we see a secular bearmarket for Bitcoin?

For the long term investor who stays away from leverage and with BTC’s adoption curve, I doubt it.

Your caveat that "all models are wrong but some are useful" is definitely one to note here. For example I know that MVRV z score is by definition flawed as it uses a standard deviation presumably assuming a normal distribution which bitcoin is anything but. Caution with leverage/capital indeed. Otherwise I've enjoyed the read.

Is your thesis however that by focusing on bitcoin and movements to the upside, you can then automatically then substitute all of that for whichever altcoin you decide to invest into?