Unpacking Aptos

Launch Review and Early Analysis

If you were on CT this past week or keeping up with blockchain news in general, the Aptos launch was all over your feed. If you’re unfamiliar it's a new layer 1 that’s been hyped for a few months now, supposedly bringing next level transaction speed and scalability. The launch has been hectic, bringing an airdrop with no clear information on tokenomics, a questionable token distribution, and a whole lot of FUD surrounding the chain’s actual performance compared to what’s been advertised. Today we’re sorting out what actually went down with the launch, as well as covering the basics of Aptos, concluding with some well positioned early builders and thoughts on the future for this chain.

What is Aptos?

Starting off with the fundamentals, Aptos is a Proof of Stake layer 1 blockchain operating on a proprietary Byzantine Fault Tolerance consensus engine. In these regards it’s similar to Solana and Cosmos, but Aptos looks to differentiate by using a modular architecture and parallel execution to enable faster transactions at scale while retaining atomicity. This is achieved through its BlockSTM parallel execution engine, and combined with Move programming language, promises 160k TPS speeds.

The other main differentiator Aptos is pushing is the developer friendliness. Contracts on the chain are written in Move, a Rust based language built by the members of the Aptos team at a previous blockchain project called Diem, which was part of Meta’s (Facebook) crypto initiative. While Meta’s overall contributions to Web3 have been disappointing so far, the company does boast a high level of engineering talent, which is a good sign for the technical competence of the Aptos team.

Move has been touted as a highly secure and flexible language for smart contracts, capable of handling massive transaction volumes. Given its more recent creation, there are a lot less experienced Move devs out there compared to a language like Solidity. This could be a barrier to entry for projects looking to potentially build on Aptos, since Move devs are more scarce. Most of the current Aptos builders are coming over from Solana, which uses similar language Rust.

Large investors and VC firms have been heavily backing Aptos, with names like Jump, Binance, a16z, and more contributing to the $350 million raise, putting it at a $2+ billion valuation. Considering the market conditions of the past few months this seems like an inflated valuation, especially for an L1 that has made lots of promises, but hasn’t actually proven itself yet. While that may say more about VC strategy than Aptos, it’s still important to consider when looking at tokenomics and assigning a fair value to $APT. Current prices of ~$9 put its FDV at ~$9 billion, while TVL currently sits at only $17 million.

Tokenomics and Launch

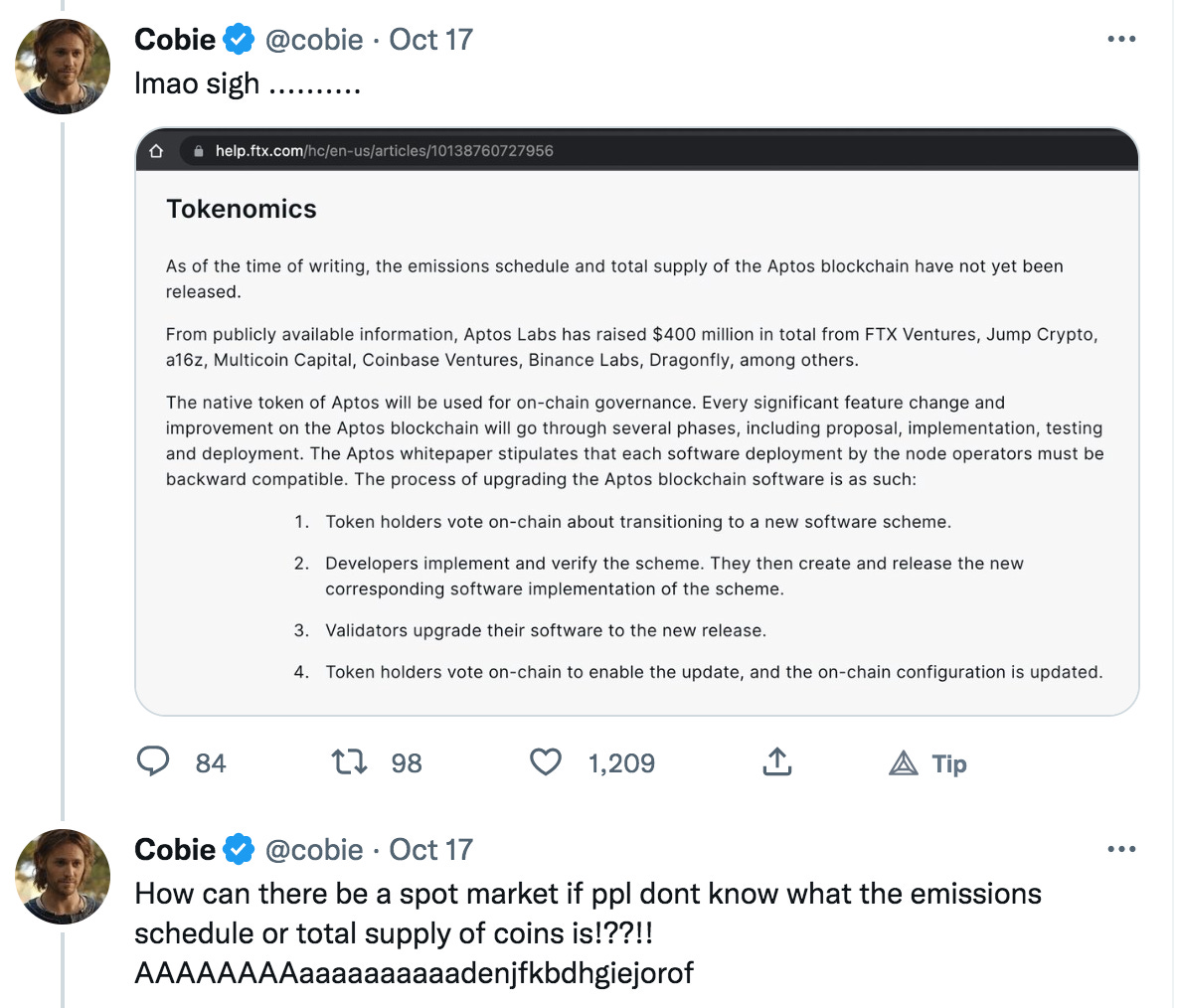

Speaking of tokenomics, this was a major unknown going into the launch of Aptos Mainnet last week, as the available information left out key details like total supply, emissions, and vesting schedule.

Cobie is saying what we all were thinking here, and for this reason several prominent CT traders advised sitting out this launch, awaiting concrete details on $APT. Initial sentiment was all over the place, ranging from calling Aptos a Solana killer, to comparisons with ICP and how that token was dumped into the ground upon investor unlocks.

Eventually Aptos released some of the missing tokenomics details, and stated there would be more information to come. Still, it's tough to imagine that such a well funded project wouldn’t have a full tokenomics description ready to go at launch, and it's even harder to believe that VCs would put hundreds of millions behind a project without knowing these details.

What we know so far:

Initial supply at launch ~1 billion APT

Token distribution

Community allocation is held by Aptos Labs and the Aptos Foundation, 125 million of which is available at launch to fund “growth initiatives” which included the airdrop and other grants to projects building on the network. As for the remainder of the community tokens the plan is to unlock 1/120th of the supply each month for 10 years.

Vesting

The core contributor and investor token vesting is more drawn out than many expected, with a 12 month lockup post-launch after which 8.4 million APT will be unlocked each month for 6 months. Afterwards, starting in the 19th month this unlock will slow down to 2.8 million per month until all tokens are vested 48 months post-launch. If there is any period where dumping can occur it’s from 12-18 months post launch, so late 2023/ early 2024.

Airdrop

The airdrop itself was a messy affair, with those who applied for testnet access and/or minted an Aptos testnet NFT being eligible for a share of the 20 million APT available. Based on Twitter reactions it seems many people had trouble claiming the airdrop, and upon launch Aptos was struggling to keep up with transaction volume. This probably has to do with the number of validators, currently 102 are active compared to over 2,000 on Solana. Even after the dust had settled somewhat, TPS was still around 15 on the network. Airdrop receivers were initially selling off their free APT, dropping prices down ~25%. However, once shorts began piling up on APT through platforms like FTX and Binance, a squeeze came in and pumped it well above the initial listing price. This combination of an airdrop plus spot and futures trading opening all at once made it a hectic first week for APT trading.

A couple days post-launch an Aptos founder tweeted out some updated stats on the chain’s performance, citing 2.5 million total transactions, 27 TPS on average, over 500,000 unique active addresses, and sub 1 second time to finality. These numbers look better than what was seen on launch day, and it’s tough to judge the actual throughput capacity without a larger magnitude of traffic on the network.

Aptos Ecosystem

A new L1 presents greenfield opportunities for new protocols to establish themselves. As usual Dexes are the first to rise as primary liquidity venues for the chain, and in Aptos’ case there are currently two standouts, LiquidSwap and AUX Exchange, commanding the majority of Aptos TVL. Liquid staking protocols are also prevalent on Aptos, providing APT holders with an option to increase capital efficiency by issuing tokens representative of a staked position for use in the wider ecosystem. APT staked percentage is currently quite high at 82%, which should be a good sign for overall network security and the potential demand for liquid staking.

Expect to see the full gamut of DeFi services roll out to Aptos soon including: CDPs, lending protocols, yield aggregators, NFT marketplaces, all the usual suspects. If you’re bullish on Aptos, these ecosystem plays typically offer higher risk/reward than a chain’s native token, and looking for winners among each of these categories could be worth some digging. Figuring out leading projects this early on is hardly an exact science, but here are a few that are trending in the right direction.

Topaz and Souffl3 appear to be strong contenders in the NFT marketplace category, with the former reporting a top 24 hour volume of $2.3 million on October 26th. As for lenders, the Aptos Foundation mentioned lending platform Njord Finance in a recent tweet highlighting early builders on the network, but the protocol does not appear to be live yet. Thala Labs is another name to keep an eye on, as they attempt to build an Aptos native decentralized stablecoin with backing from ParaFi and Aptos Foundation among others.

Final Thoughts: Just Another L1

Subjective opinion time, what’s the hype all about for Aptos? It seems like a potential opportunity for those who missed out on the early Solana/Avalanche/Fantom trades, but then you see the $9 billion FDV and wonder how in the world is APT going to accrue that much value?

In terms of the actual innovation/advancement of blockchain technology being presented, Aptos does seem to be going in the right direction. With Move being a coding language designed for transaction security and high throughput it may attract developers if those promises are delivered on. However, in the short term having a somewhat obscure coding language doesn’t seem conducive to attracting builders and the TPS is still in double digits. Decentralization is also tricky to assess, since the network is so new having ~100 validators is decent, but the permissionless vision stated by the founders is yet to be realized.

The real question is why use Aptos over other more established L1s or Ethereum L2s? At this point there isn’t much of an argument to be made as far as trilemma advancements, and it’s hard to bet on future potential/promises when the valuation is already verging on absurd. Not to say Aptos isn’t worth keeping an eye on, as there is a substantial amount of initial hype surrounding it. If that can be translated into actual adoption and growth by providing the promised trilemma progress then maybe the valuation isn’t as much of a concern. Additionally new L1s are prime opportunities for application level success, so watching for breakout Aptos protocols could be worth the effort.

Ceiling scenario: Tx speeds go way up and many Solana builders migrate to Aptos since Move is based on Rust and Aptos doesn’t experience major downtimes every other month. Aptos captures a solid amount of Solana’s TVL and becomes a respectable second tier chain.

Floor Scenario: Chain activity dies quickly after the new L1 airdrop hype fades, early investors follow as soon as tokens unlock and they can still get out above their discount price.

Final note:

Meta/FB culture is the antithesis of crypto culture, as proven by this nightmarish “wagmi” music video from Randi Zuckerberg. Maybe this is the reason why Aptos founders went their own direction, but in general, ties to Meta’s blockchain initiatives don’t inspire confidence.

Maybe I’m off base here, please voice any sound counter arguments or Aptos theses in the comments, I’d love to hear some other perspectives.