The Real Yield Hidden Gem No One is Talking About

A hot new narrative called 'Real Yield' has emerged

In a bearmarket it is easy to become disillusioned with crypto.

It was only 8 months ago that we saw new lofty APY’s on the daily and calculators that were promising lambos in the shortest of times.

The problem with most of those is that the yield came from token emissions and effectively diluting the supply. Now that we’re in a bear market the supply keeps increasing while the demand has evaporated:

How good is that 400% APY if your token is down 99%?

Perhaps as a result of this people are looking for more sustainable tokenomics and in turn a new narrative is born: The Real Yield narrative.

The Real Yield Narrative

So what is real yield?

Protocols that are running a profitable on-chain business and pay out dividends:

They have good product market fit and generate positive cashflow.

This revenue is shared with token holders in stablecoins or ETH, NOT in inflationary shitcoins.

Not too much dilution from emissions to access this yield for tokenholders.

The Real Yield narrative is indeed the hottest latest thing and gaining steam on Crypto twitter:

Here’s an example of one of the many threads/articles that have made the rounds on Crypto Twitter lately:

I generally see the same usual suspects in every thread and article on the matter:

GMX ($GMX)

Gains Network ($GNS)

Synthetix ($SNX)

Umami Finance ($UMAMI)

Trader JOE & Beefy Finance

DOPEX ($DPX)

Redacted Cartel ($BTRFLY)

Kujira ($KUJI)

LooksRare ($LOOKS)

Today I’ll cover a project that fits the real yield narrative, but haven’t heard about: STFX.

The reason you haven’t heard about it is because it’s yet to launch.

Yes, anon, you’re that early.

What is STFX?

Disclaimer for the fellow apes:

I'm a moron on the interwebs that you've never met, who may or may not have lost his lifesavings 100x over. This is NOT financial advice. Furthermore as I have found this gem and loved the idea, I am personally invested and therefore have extreeeme cognitive bias.

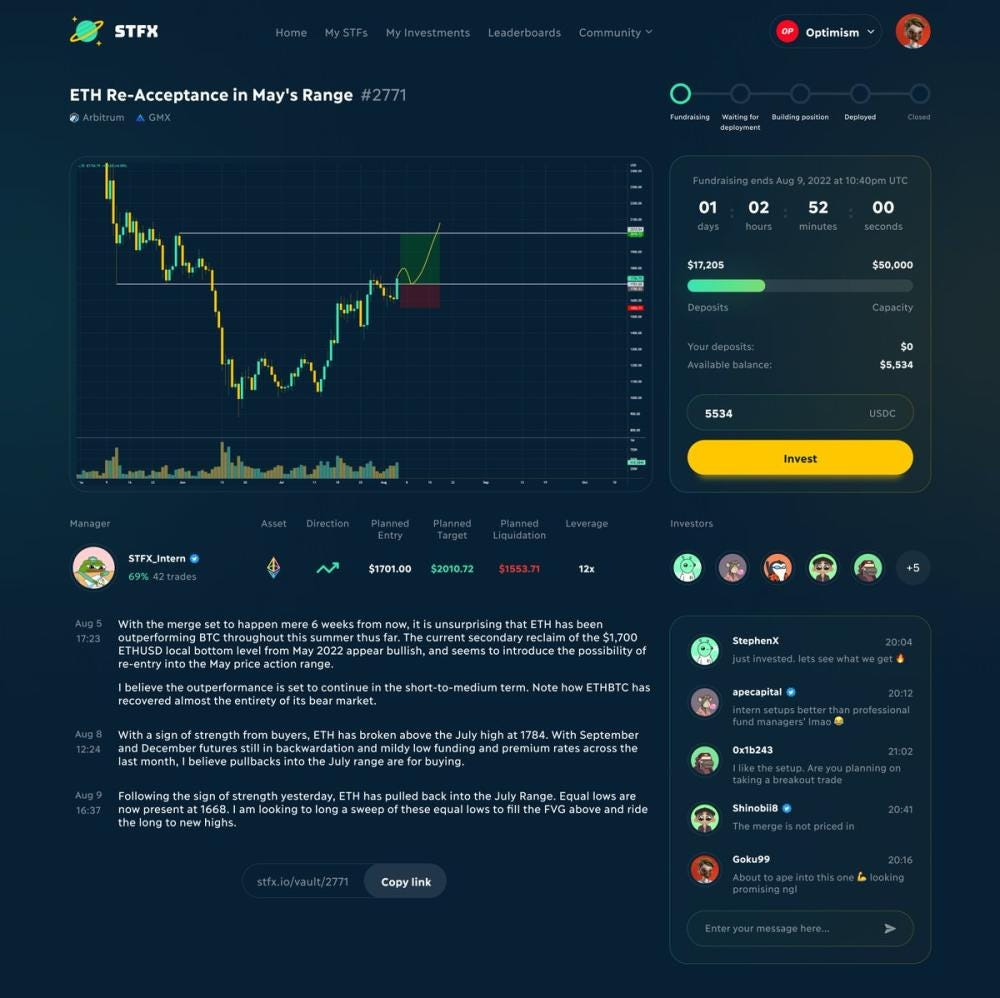

Single Trade Fund Exchange (STFX) is an exchange of the new concept of the Single Trade Fund (STF): a “short duration, non-custodial, actively managed vaults that are dedicated to one trade.”

1 STF = 1 vault = 1 trade

Let’s say there’s information asymmetry, you have a clear edge and you want to raise capital for that. So you’re sitting down with a lawyer doing all the paperwork then raise money for your fund. You execute your trade, take profits and distribute the capital to everyone who joined in (after charging a performance fee). Then you again sit down with the lawyers to absolve the fund.

So with an STF you don’t have to bother with all the legalities, it happens all on-chain after a few clicks.

STFX will initially launch on Arbitrum & Optimism.

Look at a hedgefund in an abstract way:

A fund is really a series of individual trades over time. STFX wants to unbundle that into a series of mini-funds and allow people to have a choice to partake in each individual one.

Here’s another way to conceptualize it.

Some of you might be familiar with the ‘Ideas’ section in tradingview:

It’s a section of tradingview where you can browse through the trade set-ups that different traders share.

Now imagine that on top of that you could:

see this particular trader’s track record and verify it on-chain.

invest in these trade ideas with a couple of clicks.

be in a chatroom with the trader himself as he executes the trade and learn from him.

Experience the emotions of winning or losing with fellow degens who invested in this trade idea.

So what prevents you from just copy trading or counter trading the STF managers, you might ask?

Firstly, execution is at the discretion of the trader. While the planned entry states one thing, he may enter at a different price.

Furthermore STFX will allow anyone to create a STF idea and obfuscate one of the parameters of the trade. Over time as you have more trade history and ‘level-up’ as an STF manager, you get to hide more than one parameter allowing you more freedom while still profiting from well-executed trades.

Tokenomics

Revenue is generated by STFX through a 5% performance fee on each winning trade (not on break evens or losses)

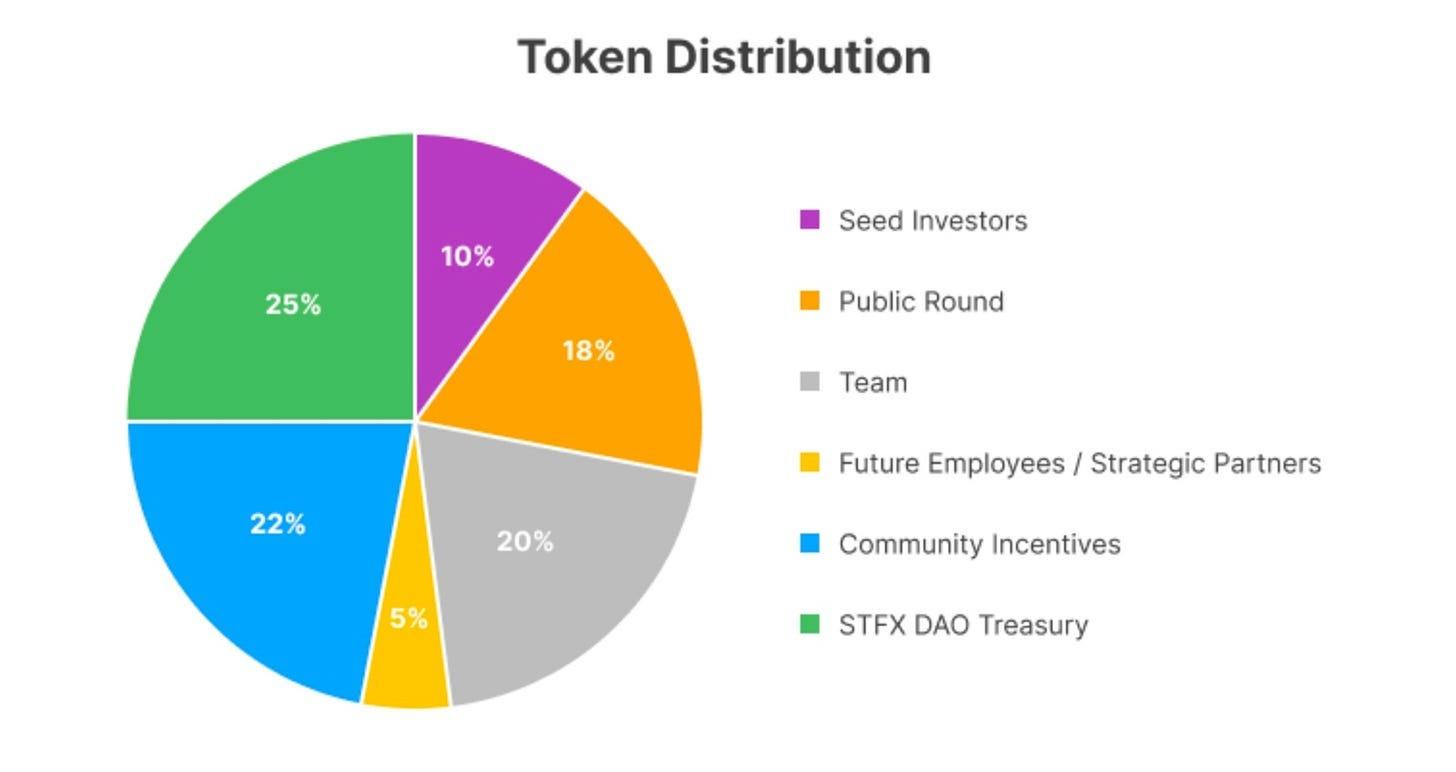

STFX stakers will receive claim to 80% of protocol revenue, with the remaining 20% accruing to the DAO treasury. Rewards will be paid out to stakers in USDC on a weekly basis.

Additional Token Functionality:

Fee Rebates for managers AND investors

Access perks more quickly for managers who stake STFX

Large STFX token holders will get Priority Access to oversubscribed vaults

STF managers can stake and/or buy and burn STFX to get higher visibility on the protocol’s discover page

Governance

Total supply capped at 1,000,000,000.

Seed Investor’s tokens have a linear 12 month vesting period.

The Public Round is scheduled for sometime in October ‘22.

Community Incentives: I expect a large amount to be used during the launch of their testnet/mainnet for early STF participants.

Roadmap

STFX starts off with GMX integration, but intends to integrate more derivative DEX’s over time. Given there is product market fit, the roadmap includes spot, options and NFT trading to allow for more complex strategies. Also a countertrade feature, trailing stoplosses, TWAP style entries and twitter verification integration are on the map.

Reasons I’m bullish on STFX:

Tokenomics & Real Yield paid out in USDC/ETH to STFX token holders

Crypto as a big decentralized casino thesis. The house always wins, STFX is betting on the house.

DeFi Asset Management market is currently non-existent

We all do social trading in Crypto already, clear product market fit

Great team with even better connections

Real Yield

Revenue is generated by STFX through 5% performance fee on each winning trade.

STFX stakers will receive claim to 80% of protocol revenue.

Crypto as Decentralised Casino

During the high days of the bullrun you can imagine most crypto projects revolutionizing the world, but during the darkest days of the bearmarket the best thing we can come up with is that crypto is a big decentralised casino. It will always be too expensive for the average man to fly to Macau or Vegas. The void left by web3.0 is quickly becoming filled by the decentralised casino narrative.

While I am still too idealistic at heart to think that’s all web3 has to offer, it is undeniable that gambling fueled by human greed is not going anywhere. In 2021 just leverage trading of BTC & ETH alone has quietly grown to be 20% of all global gambling expenditure.

How do you profit from the ‘Crypto as the Decentralised Casino’ thesis?

With gambling the house always wins, so you want to bet on the house. In Crypto that means you bet on a protocol that captures value from trading no matter if the price goes up or down. Then make sure holding the token actually gives you access the profits captured by the protocol.

That means protocols like GMX, GNS, LOOKS, DPX. But also STFX.

DeFi Asset Management market is non-existent

People have been trying to build decentralized asset management (onchain funds) since 2014. It predates DeFi by years. And yet, despite all the attempts, it never really took off. I think it’s because of a bad market fit. DeFi Asset management is boring and unpopular. Existing solutions focused mainly on 1x Spot portfolios and indexes. The time to see results is long, measured in weeks/months not days.

There is a disconnect between existing DeFi asset management vs. the market participant in crypto.

The average crypto degen would rather long ETH at 20x into the merge, yolo money into meme coins or other risky shitcoin plays. A lot of crypto natives have screwed up dopamine systems and a short attention span.

High risk, high reward is the name of the game.

Current DeFi asset management doesn’t even come close to satisfying that need for dopamine, but also the social aspect and gamification is missing. If you compare that to being able to invest together with your fellow degens in your favourite trader’s generational ETH Long and be in the chat with him as he’s executing it, it’s a world of difference.

In comparison to other DeFi vault offerings, STFs take up a unique niche. They are shorter in duration and capture higher volatility than any other vault out there at the moment.

We All Copy Trade Already

Crypto is a 24/7 market. It’s an asset class that never sleeps. For better or for worse, we’re all on CT and other social media experiencing the extreme highs and lows of one of the most volatile asset classes in history together.

Everyone is constantly looking for alfa, for asymmetric opportunities and for an edge in this market that moves at breakneck speed. If you’re a fund manager, have a paid group or paid subscription you’re under constant pressure to perform, share alfa and set-ups even when the market conditions might not be ideal. It can be exhausting.

STFX allows you to take trades when the set-up is there and you’re not under pressure to perform after the trade is finished.

Even Cobie thinks STFX is a great idea and monetizes something that we all do already.

For better or for worse social / copy trading is already happening on Tradingview, Twitter, Discord, Telegram, etc. There are paid groups, private telegram & discord groups where traders share entries, exits and stoplosses. This shows that traders are willing to share their edge with others for a price. But the current solutions haven’t been able to attract the lion’s share of the market. The problem with these is that there’s no accountability and it’s hard to figure out whether the trader’s ‘alpha’ is fair value. Also there’s a taboo in the trading world of asking for financial compensation for sharing your wisdom. If you’re such a good trader, you certainly don’t need the money, right? As a result many traders choose to shy away from current methods of monetization and instead only occasionally share their trading calls on twitter for free or for clout.

You’ve probably heard that 95% of traders are not profitable over a longer period of time. Similar to poker players they go through boom and bust cycles. Sooner or later people go on tilt and lose big. So while you could have a great high time frame directional bias and could be great at reading the market, you could be absolutely horrendous at the execution. This is a problem that can’t be overstated enough.

To attain a truly statistical & analytical mindset that’s free from cognitive bias and fear and greed is exceptionally hard to attain. Therefore the majority of people will be better off putting their funds in the hands of an excellent STF manager with proven track record than try to make it by (leverage) trading themselves.

Trading is a competitive and zero-sum game. We all know some big names in CT larp as traders. While they could still post good set-ups, they could be horrendous at execution and really just take the profits from their paid groups and bybit referral links. But it’s not easy to find out who’s lying and who’s real. The amount of times I’ve seen big traders accuse each other of larping on Crypto Twitter…

In the future this can easily be solved by showing good winrate, good pnl or that you trade in your own STF’s with size. I can imagine a future where if you can’t show any of these on STFX you lose credibility.

Imagine being able pick a side and pile into the bet of Algod & GCR vs. Do Kwon?

Great Team with the Connections to Pull it off

Arguably to create a platform where all this social/copy trading is aggregated, you need to get the best traders on board and then get the rest will follow.

Connections matter.

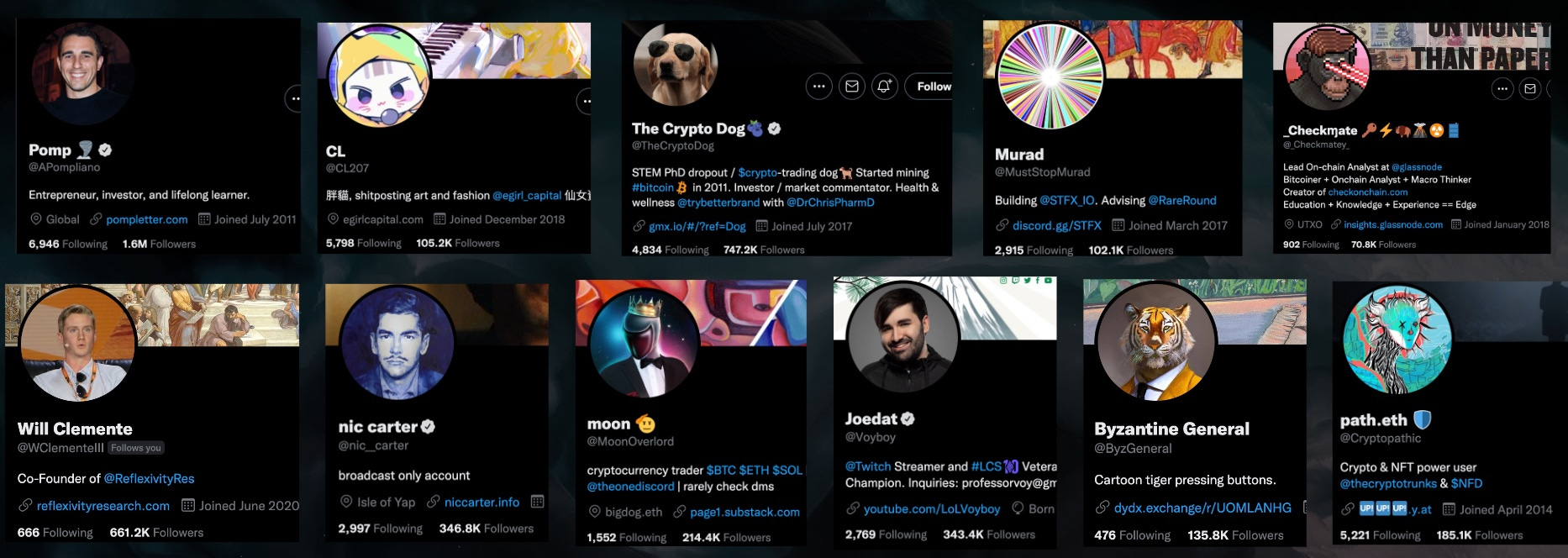

Meet Murad, One of the founders of STFX:

If you’ve only been around for one bullrun this name probably doesn’t ring a bell. But he was a legend during the previous bullrun, but went underground in March 2020. He magically reappeared in June as a knight in shining armor during the darkest day of our bearmarket following the capitulation as a result of Luna, 3AC, Celsius etc.

This is just a snapshot of the warm welcome he received. As you can see some big traders and big CT names in there.

Why do I say Murad reappeared as a knight in shining armor? Well, because he gave us all some hopium and courage to Buy the F**ckng Dip with some incredible charting:

Murad and his team raised $2 million for his seed round from 60+ mostly independent angels and CT traders, only a few small VC’s with an overall average cheque size of about $35k.

While some argue that a fair launch would have been better, we argue that current launch is at least better than the normal raise which generally includes just a few big VC’s. STFX in comparison will have less dumpooors.

Either way, having a group of DeFi & CT influencers as well as great traders with skin in the game who therefore want to start using the platform is essential to jumpstart a Social Trading platform.

Great traders use the platform and big CT names get the word out and the rest will follow.

Also the man GCR himself is hanging out in discord. Probably nothing.

How to get whitelisted for STFX?

Something tells me that they’ll launch soon…

They will start their whitelisting process for their public round soon. And also in the initial stages of their product they’ll have some big community incentives. Keep an eye on the announcements in the STFX Discord.

Head over to their Discord here.

Further Reading:

Website: http://stfx.io/

Docs: https://docs.stfx.io/

Twitter: https://twitter.com/STFX_IO

Medium: https://medium.com/@STFX_IO/introducing-stfx-6c54e630cede

https://medium.com/@STFX_IO/decentralized-asset-management-2022-64b12e459a10