LayerZero: Interoperability For All

A report on the tech, problems it solves, and what's being built on top of it

The Cross Chain Future

With such a variety of layer 1 chains in existence, it would make sense for there to be a method of efficient and secure communication between them. A simple concept, but one with wide reaching implications for the future of decentralized finance. This is the objective of LayerZero, to facilitate cross chain messaging in a way yet to be seen in crypto. This report will cover in depth the technology behind LayerZero infrastructure, the problems it solves, and the use cases it opens up.

Founders Bryan Pelligrino, Ryan Zarick, and Caleb Bannister envisioned an omnichain world where users and liquidity are no longer fragmented between various L1 ecosystems, and in March 2022 the LayerZero interoperability protocol was launched. L0 Initially supported 7 major blockchains; Ethereum, Avalanche, Polygon, BNB Chain, Fantom, Arbitrum and Optimism, and has since added others like Harmony, Solana, Polygon and more. Here’s how the infrastructure allows these previously siloed chains to communicate with each other.

As demonstrated in the graphic above, a LayerZero endpoint is established as a smart contract on each of the supported chains, a hub between which cross chain messages (aka transactions) can be sent and received. The endpoints contain messaging libraries, called Ultra Light Nodes, and a proxy to direct messages to the correct library. In between the endpoints sit a relayer which submits proofs for transactions, and an oracle which broadcasts the block header containing the transaction. Validation and consensus for the transactions are handled on the respective source and destination chains (A and B in the diagram). This system is the core innovation of LayerZero, and is the best combination of secure and inexpensive cross chain messaging currently available.

Dapps that are looking to provide cross chain capabilities can then integrate L0’s services into their application, allowing users to transact across chains. This opens up the possibilities for interchain dexes, NFT marketplaces, yield products, lending, and improved bridging. With bridging in particular being much in demand and having a notorious history of hacks/exploits, it’s no surprise that LayerZero is tackling this use case with its own bridge.

Stargate: Innovation in Bridging

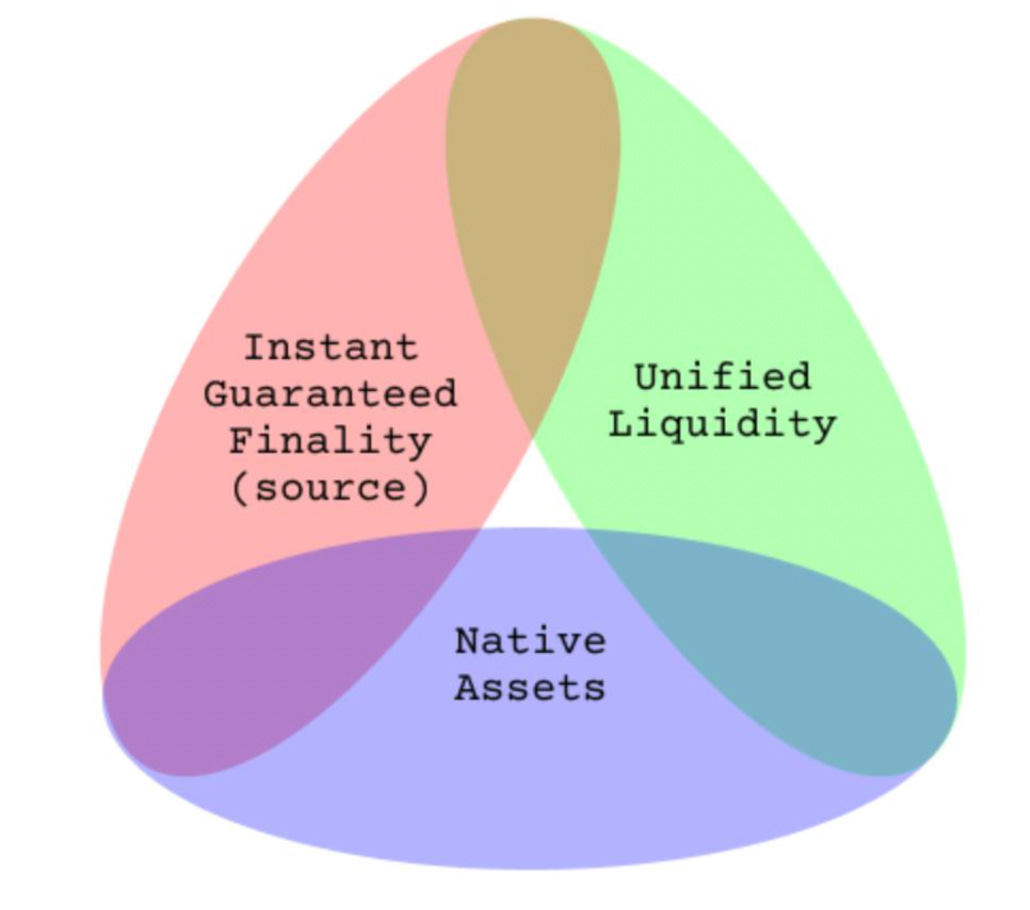

Stargate is the flagship dapp built on top of L0 infrastructure by the same team, with the objective of solving the bridging trilemma. The three components of this problem are fast time to finality, providing a unified liquidity venue between multiple chains, and transacting in native assets instead of wrapped assets.

On top of these three obstacles, the traditional bridging process involves multiple transactions and many steps in order to get from token X on chain A to token X on chain B. Even more concerning is the amount of massive hacks that have targeted bridges, with names like Wormhole, Nomad, and Ronin coming to mind.

Stargate aims to solve the bridging trilemma while also streamlining the bridging process down to as few clicks as possible, and provide a secure environment for interchain liquidity. So far, this approach has been well received by the DeFi community, evidenced by its top 5 spot on the overall bridge volume chart. Excluding chain specific bridges, Stargate is second largest by volume, trailing only Multichain.

In addition to ease of use and a plethora of chain options, Stargate also benefits from an untarnished reputation as far as hacks and exploits go. One of the reasons behind this is another LayerZero technology, Pre-Crime. This allows for testing of a transaction on a local fork of the destination chain to see if it’s malicious, enabling the relayer to stop the exploitative tx before it’s committed.The LayerZero team initially deployed Pre-Crime on Stargate to test its efficacy, and as of September are rolling it out to select protocols via private beta.

Airdrop Strategy

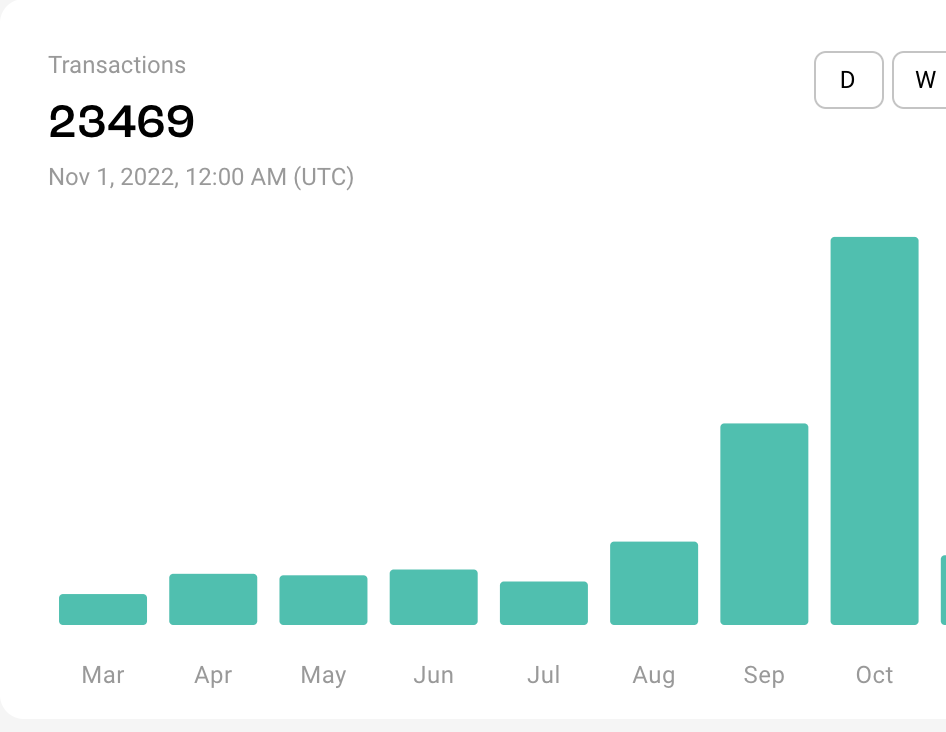

Stargate usage has picked up significantly in Q3, and besides it being a top tier bridging option many DeFi enthusiasts are speculating that activity here could be a qualifier for a L0 airdrop in the near future. No official confirmation on the airdrop has been given yet, but it is widely expected to be conducted in the coming months. Beyond the rumors there is mention of a ZRO token in the LayerZero Github repository, so while not officially confirmed, it’s certainly in the works. For a step by step guide on $ZRO airdrop qualification, check out this thread by CT gigabrain Corleone. Like most of the airdrops seen recently, using LayerZero integrated projects like Stargate is the main strategy, and can be done with a small amount of capital so there’s no reason not to try and qualify here.

Use Cases

Beyond improved bridging there are plenty of other use cases for LayerZero tech to be integrated into all sorts of DeFi protocols.

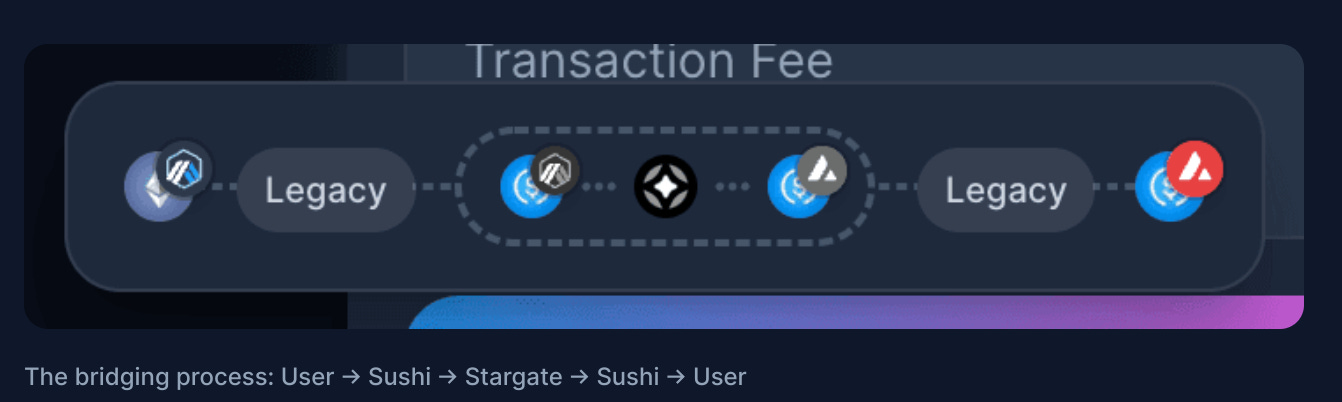

AMMs: Integrating L0’s Ultra Light Nodes will allow for the creation of interchain exchanges, where users can swap from asset X on chain A to asset Y on chain B in a single transaction. No bridging, no wrapped tokens, just trustless native token swaps between any of the L0 supported chains. Sushiswap was the first to go down this omnichain dex route, introducing SushiXSwap built on top of Stargate. Below you can see how SushiXSwap functions internally, but on the user end it happens in one streamlined transaction instead of going through multiple dexes and bridges as was previously the norm for moving across chains.

NFTs: Similar to the AMM use case NFTs will soon be seeing LayerZero incorporated into marketplaces for interchain swaps, a move that helps defragment liquidity, and adds another touch of significance to what is essentially a “flex asset”. To break that down, with omnichain NFT marketplaces users can purchase AVAX NFTs with mainnet ETH, or vice versa. This type of unified liquidity venue for NFTs will make it easier to transact in what has always been a relatively illiquid asset class. Secondly, NFTs will become natively omnichain, using modified token standards to allow them to deploy on multiple chains at the same time, and much like any “luxury” good this new feature will bring some extra prestige with it. OmniX is one of the first projects building for NFTs on top of L0, with the impending launch of their omnichain marketplace/launchpad.

Disclaimer: PHD capital is invested in OmniX, and as always these reports are purely informational and not financial advice.

Lending/Borrowing/Yield Aggregation: TapiocaDAO combines these DeFi primitives with LayerZero tech to enable cross chain borrowing and lending, streamlining the process of moving funds around to access different yield opportunities. They implement Sushiswap’s Kashi Lending protocol to facilitate loans across chains, so for example a user could deposit Arbitrum ETH to borrow Avalanche native AVAX. Tapioca also provides chain-agnostic yield aggregation through BoringCrypto’s Yieldbox, a BentoBox style yield optimization product allowing users to find the best yield sources within their risk parameters.

Another Interesting Yield Protocol: Superform is also looking to improve yield composability through interchain connectivity, aggregating opportunities into a single marketplace. This protocol is yet to launch, but already has financial backing from some major names including Arthur Hayes of Bitmex, Avi Felman from Goldentree, and LayerZero’s Bryan Pelligrino. This project will leverage the ERC-4626 standard for tokenized yield vaults, allowing users to build a customized yield portfolio across multiple EVM chains.

This is far from an exhaustive list of projects being built on top of LayerZero, but does give some solid examples of the doors it opens up. Essentially any DeFi tool now has the ability to be enhanced via cross chain access, resulting in more unified liquidity, and expanded options for users without the hassle of traditional bridging.

Potential Risks of the Infrastructure

While LayerZero is a strong step forward for chain level interoperability, it’s not a perfect system. Going back to the Ultra Light Node setup, there are some concerns surrounding its robustness compared to other interoperability systems. Since it does involve third party oracles and relayers (Chainlink is the default oracle, but anyone can set up their own) so there is an element of centralization/oracle risk involved. Possible collusion within these components could result in malicious transactions being passed, but placing some level of trust in Chainlink oracles is commonplace in DeFi at this point in time. With the expansion of Pre-Crime this risk will be further mitigated as well. One interesting theory that seems to make sense here would be an introduction of PoS style staking/bonding of the expected $ZRO tokens for relayers, which could be slashed in the event of improper relaying.

Opinion

Ultimately, a completely trustless environment for cross chain transactions would be ideal, but with demand on the rise for a workable interoperability solution, LayerZero seems like the current best bet. Cosmos IBC is arguably a better system in terms of security while maintaining ease of use, but since it is limited to that specific ecosystem LayerZero wins out especially when it comes to connecting EVM/non-EVM chains. There will likely come a new and improved standard for interoperability in the future that supplants LayerZero, maybe IBC gets there, or maybe L0 evolves into a trustless solution eventually. For now, it addresses plenty of pertinent issues, and boosts DeFi composability, making it a solid step forward and attracting an assortment of builders. Take advantage of the all but confirmed airdrop opportunity, and keep an eye on protocols incorporating LayerZero.

As always, we would love to hear your thoughts on LayerZero and any related projects of interest, so feel free to drop any comments or questions. Thanks for reading!