Finding Alpha On-Chain

Educational Short Story; Finding a gem related to Arthur Hayes

Hi, DeFi_Educator here.

This article was originally posted on my medium. This will be my last article for PHD Capital for a while.

In the meantime I’ll continue sharing alpha on my Twitter and Medium

There is a sub $10m marketcap shitcoin (at the time of writing) that I will be looking to pick up over the coming few weeks with the potential for downside volatility surrounding the SEC going after banks and exchanges and the S&P500 looking weak.

Let me take you down an on-chain sleuthing rabbit hole…

But before we go down the rabbit hole, let me tell you about Arthur Hayes.

Why?

Because he has 350k followers on twitter and 70k followers on medium and they’ll be our exit liquidity.

I’m a big fan of Arthur Hayes, if you don’t know him, go check him out. The founder of BitMex and 100x leverage and is known liquidate his clients trading on BitMex. Arthur -run-the-stops- Hayes is a true degen at heart, and in recent years turned into one of the most brilliant writers in crypto. He has a way of explaining macro economics to us crypto degens like few others can; breaking down difficult concepts in our lingo and in bitesized chunks so our screwed dopamine TikTok brains can understand.

In his latest article, which you can find here. He explains why the BTC & ETH bottoms are in, and we will be going up until we have to raise the debt ceiling. Arthur explains why:

TL;DR is this: due to the US government hitting the debt ceiling, the Treasury General Account (TGA) will be drawn down. The US Treasury has about $500 billion sitting in the TGA (i.e., its checking account). The US Treasury can roll over expiring debt, but it cannot issue new debt — that is, debt that would increase the aggregate balance of US Treasury bills, notes, and bonds outstanding. So, if the Treasury wants to incur new expenses, it must pay for them out of pocket. That means the Treasury is likely going to spend all $500 billion of the TGA into the US economy, adding liquidity to the system and lifting risk asset prices.

He then proceeds to explain the TLDR from above in great detail throughout the article and explains the next likely steps:

Buy bitcoin

Go shitcoin

Pull out before the unwind when TGA stops (before summer).

Now read the part about Shitcoining carefully:

“There’s currently a narrative taking hold.”

“And I will give you guys an update on my thesis on this sector of dog shit.”

The Narrative & Thesis

If we find this narrative and thesis before he shares it on his next articles, we have a clear edge. I’ll explain here why I think I know his narrative & thesis because the blockchain doesn’t lie.

It is no secret that Hayes is a big fan of GMX (1)(2).

It is also no secret that he’s a big holder of GMX and effectively holds >2% supply, which equals ~$13million (3)(4).

If you go to Arkhamintelligence you’ll get this address. Same on Nansen. We’ll refer to this address as ‘ArthurHayes1’

Publicly known Arthur Hayes Address: https://platform.arkhamintelligence.com/explorer/address/0x534a0076fb7c2b1f83fa21497429ad7ad3bd7587

Here we get a sense of holdings the wallet ‘ArthurHayes1’.

https://debank.com/profile/0x534A0076fb7c2b1f83FA21497429AD7ad3bD7587

Post FTX implosion he wrote several articles to explain in-depth how FTX is not a story of the failure of DeFi, but rather a failure of CeFi which does not equal a failure of crypto. On the contrary DeFi was designed for exactly this problem.

One of the big use cases of crypto ironically has been as an online casino. There will always be a need for leverage and thus for decentralised leverage platforms. GMX has been a stellar performer this bearmarket, outperforming BTC & ETH and is even up in dollar terms, which is telling.

I believe this to be the “narrative that’s taking hold that’s inspiring a lot of copy-pasta piles of shit to launch”. It is a Real Yield narrative of decentralised perp platforms that share the revenue with token holders.

The Rabbithole

Here’s where it gets interesting for those of you who like on-chain wallet watching:

Arthur’s Main Wallet is kind of well-known… so if he wants to shitcoin it makes sense that he would do that through other ‘unknown’ wallets.

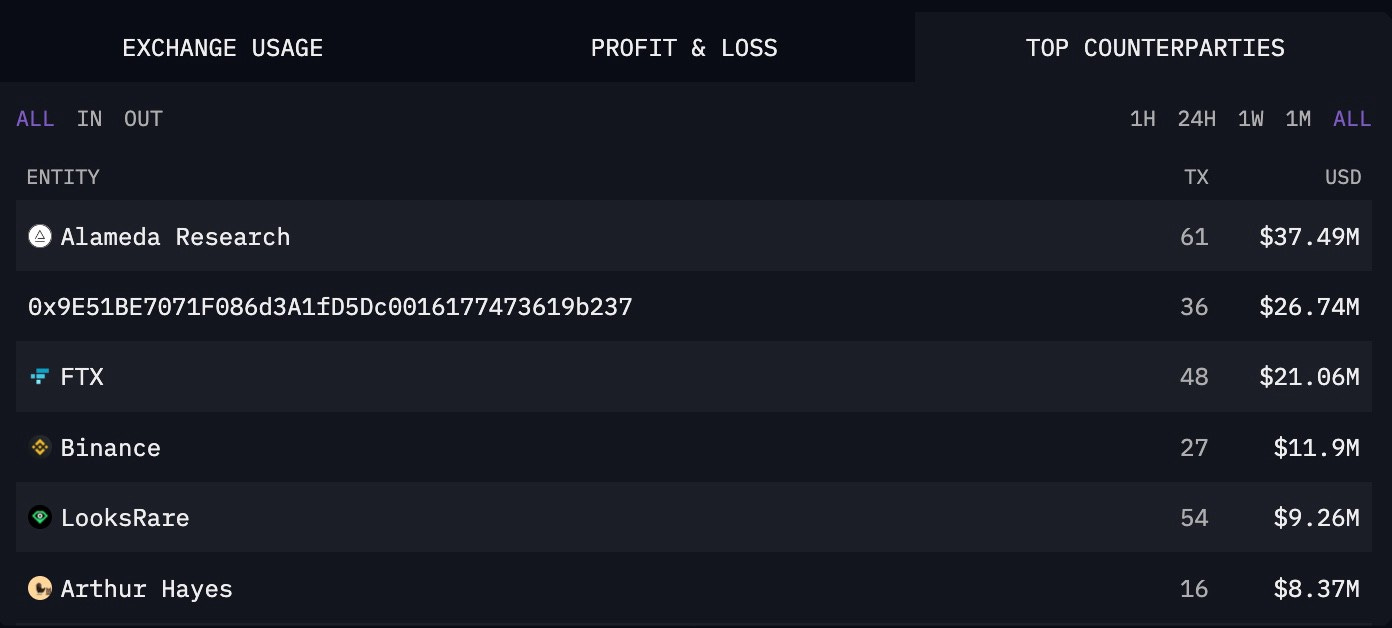

So using Arkham Intelligence we’ll look at top counterparties of his main wallet across all-time.

Unless he went through a Centralised Exchange or Tornado Cash, a secondary wallet would show up here… and it does: 0xA86..506F.

0xA86..06F. We’ll call this one ‘ArthurHayes2’.

After making sure it’s not a contract address, an exchange and looking at behaviour and holdings, I’m confident this is an Arthur Hayes wallet.

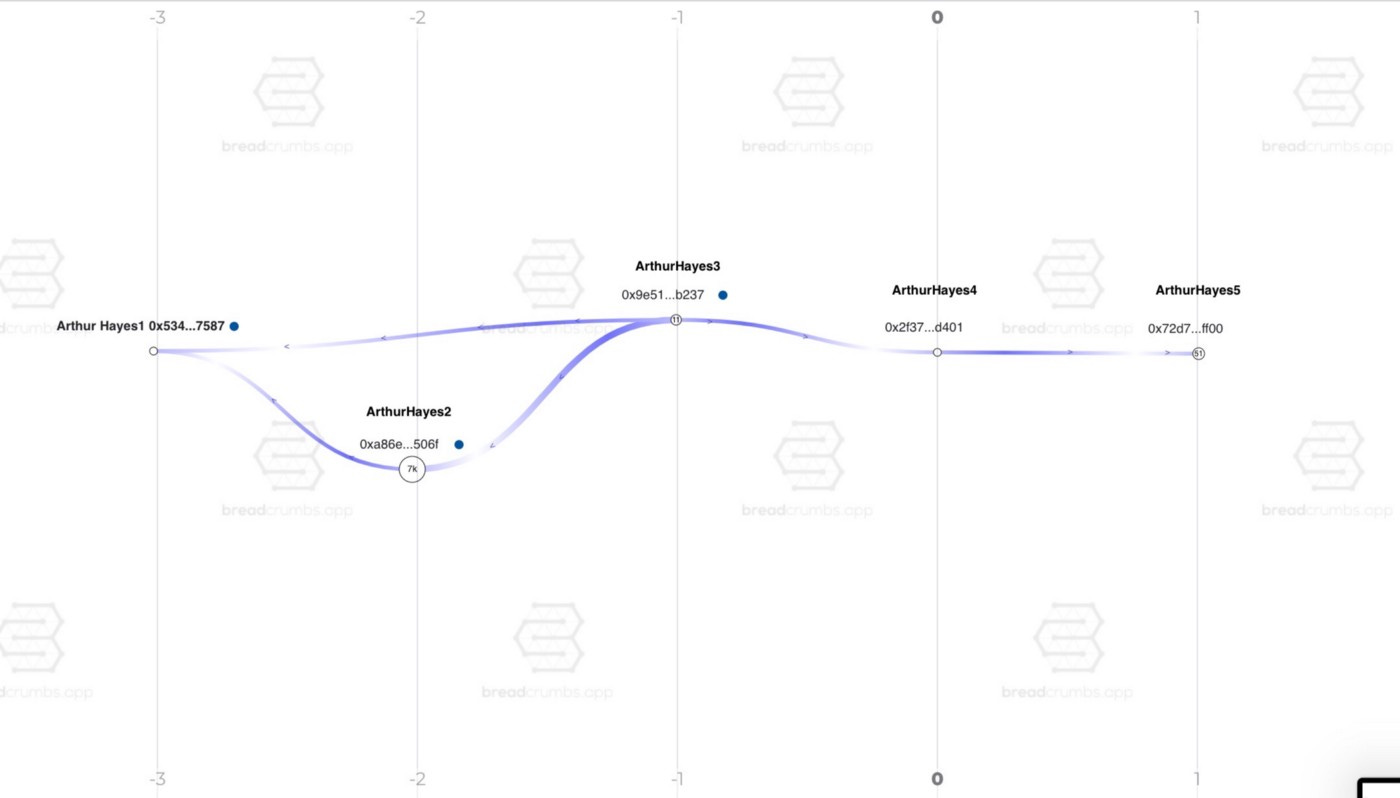

Now we run the same trick again: using Arkham Intelligence put in our newly found address ‘ArthurHayes2’ and look at top counterparties.

A new ‘secret’ wallet address of Arthur Hayes is found: 0x9E5…9b237, which we’ll refer to as ‘ArthurHayes3’ from here on out. This one also fits the profile, and is not an exchange or smart contract address etc.

So doing the same trick once more we find 0x2f3…d401. We’ll call this address: ‘ArthurHayes4’.

We’re now several steps away from his known wallet.

How do we know these wallets are truly from Arthur Hayes?

If the first ever transaction to this new address was by an Arthur Hayes wallet, it means it’s funded by him. This increases the likelihood that he’s indeed the owner. So in this case the first ever funding of this address is our previous ‘ArthurHayes3’. The same applies to ArthurHayes3, which was first funded by ArthurHayes2.

100 ETH tx at the bottom is the first ever tx into this wallet. Showing that ArthurHayes4 is directly funded by ArthurHayes3.

Now doing the same trick one last time we get 0x72d…dff00 which we call ‘ArthurHayes5’.

I know, I know, this on-chain stuff can get tedious and frustrated. You’re almost there.

So to summarise;

While Arthur Hayes did his best to throw us off his scent, this is what we did so far:

Now if we run a google search on address ‘ArthurHayes5’ (0x72d..ff00) this search result pops up with a link to twitter:

The medium article linked in the tweet is here.

It describes that Level Finance had gotten a $100,000 investment from an ‘unknown investor’. The address given in the tweet/medium article is the same as our ‘ArthurHayes5’ wallet.

So we now know that this private investor is most likely Arthur Hayes. 👀

So we established that investor is probably Arthur Hayes.

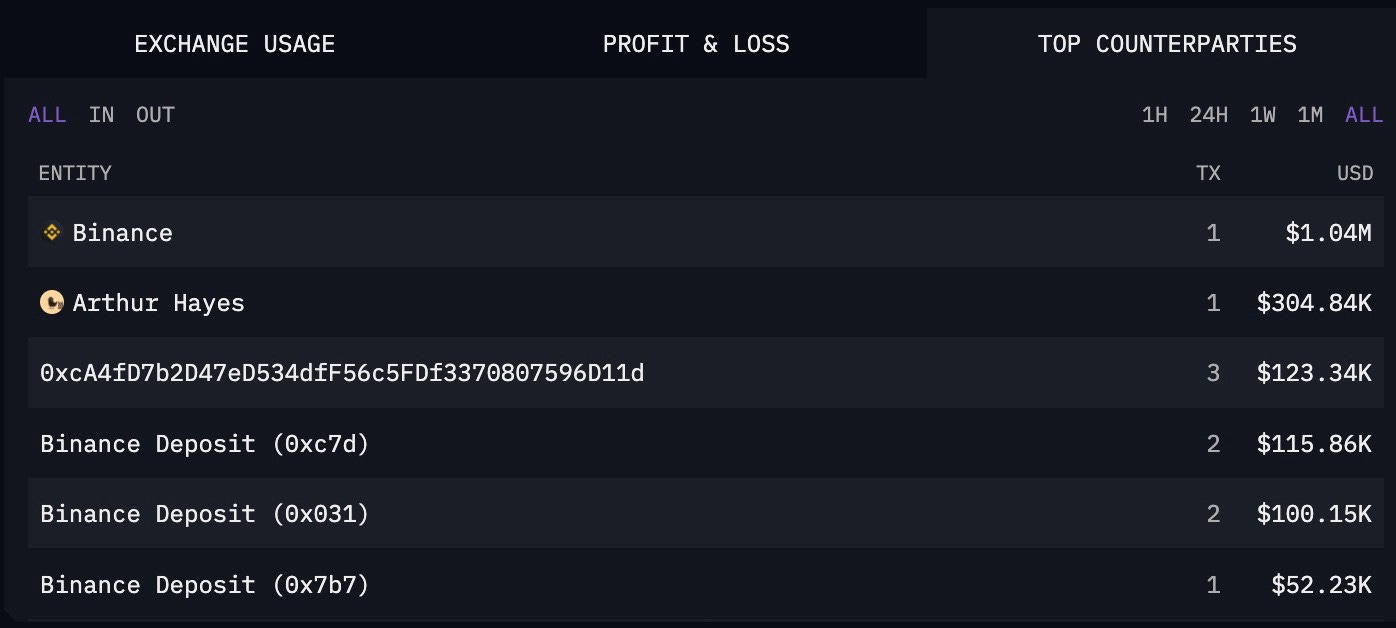

But there is a different address given in the vesting contract that distributes the tokens. So ideally to make our case as soundproof as possible, we want to establish a connection between this address and a wallet funded by Arthur Hayes as well.

As we can read in the LVL Finance medium article the vesting contract is:

https://bscscan.com/address/0xA67FBecEa04d09a96b6153651093732352A45FFf#code

Looking at the smart contract we can see the investor’s address: 0x72df34fb807a17371c19824d51b697e295ccccc6

Using Arkham Intel on this wallet we see that one of the top counterparties is his public GMX wallet, ‘ArthurHayes1’.

So summarising we can now conceptualise the flow of money as such:

Ok. Looking back on the chart it is apparent that some alpha hunters (not me) were onto this quite quickly, as in instantly:

To Ape or not to Ape?

I started writing this medium article early February when price hovered around ~$2.5. Since then I’ve seen some people spill the beans on Twitter and recently price ran away to > $7. This alpha may have decayed. Therefore please view this is an educational post only, not financial advice;

As with any potential gem, the question you have to ask yourself:

Is this priced in, how many early alpha hunters have come before me? Is the alpha still alpha?

How is the current backdrop of the macro environment, if BTC shits the bed, what will happen to my shitcoin?

If Arthur Hayes’ tokens are locked for 12 months, what if he doesn’t shill it in his next couple newsletters. Do I still want to hold this?

What is the emission schedule like and the Fully Diluted Valuation… who can dump on me?

Is this a GMX clone, or something original? If it is a fork, what has happened to other forks of hyped projects on BSC in the past? Based on that do I want to play this as a short term trade or long term hold?

That’s just some of the questions I would ask myself aside from the normal due diligence on a project.

But hey, what do I know?

I’m a moron on the internet you’ve never met, who has gambled his father’s retirement away twice over, and who’s certainly not in a position to give financial advice.

PS. I could have come to the same conclusion using Nansen, Debank or Etherscan, but I decided to give Arkham Intel for a spin. I’ve got about 10 invites left for Arkham Intelligence.

Dm me on twitter if you want free trial.