Cosmos 2.0: A New Frontier for Interchain

The plan to defragment Cosmos’ ecosystem and improve value accrual for $ATOM

Exploring the Cosmos

Initially looking to be one of the hotter ecosystems of 2022, Cosmos growth has been held down over recent months due to a combination of overall poor market conditions and ATOM’s less than ideal tokenomics. Now the Internet of Blockchains is proposing some big changes: improving interchain transaction, making it easier for new chains to bootstrap validators, and most controversially reworking ATOM tokenomics. Today we’re covering all the major elements of Cosmos 2.0, along with the strengths and weaknesses of Cosmos as a whole.

Cosmos Basics

Quick background on what Cosmos is all about. It’s composed of various “zones”, each of which operates as its own chain, handling the data availability, consensus, execution, and security. Think of Cosmos itself as a Layer 0, the building blocks for blockchains. The unique feature of the ecosystem is its interoperability, facilitating communication between these app chains via IBC enablement. Cosmos also provides builders with their SDK, allowing for quick deployment of PoS or PoA chains, as well as the Tendermint engine, a prebuilt Byzantine Fault Tolerant consensus mechanism.

With these three tools available to simplify deployment, consensus, and networking, developers are able to focus more on the applications themselves while realizing the benefits of customization that an autonomous chain offers. ATOM is the ecosystem’s work token, primarily used for staking and governance, but also serving as a key asset for interchain liquidity. Cosmos also has its flagship chain, the Cosmos Hub, which is essentially a marketplace for protocol services such as validating.

Ecosystem Architecture- via Cosmos.network

App Chain Dynamics

Not going to dive too deep into the app chain vs shared Layer 1 debate here, let’s just say there are pros and cons for building an independent app chain, whether it’s via Cosmos, Avalanche Subnets, or Polkadot.

On the plus side: having your own chain makes for predictable low transaction costs, prevents value from leaking to external validators, allows for fine tuning of blockchain trilemma tradeoffs, and provides an additional layer of sovereignty since protocols aren’t beholden to external platform governance. Downsides include: having to bootstrap validators, reliance on cross chain bridges, and asynchronous composability across app chains.

Where Cosmos truly stands out is the possibility of ecosystem plays, as projects look to expand horizontally and provide a suite of dapps operating on the same independent chain. This is what Cosmos is attempting to usher in with the upgrades presented in 2.0.

Platform Upgrades

Several of the areas being addressed by the new road map are issues we’ve just touched on. Validator bootstrapping looks to be improved with the introduction of Interchain Security, and the new Scheduler and Allocator mechanisms aim to smooth out the interchain transaction process. On top of the technical advances, Cosmos is planning a complete revamp of its staking token $ATOM, winding down its inflationary mechanics until a steady state of emissions can be reached. In exchange for reduced emissions ATOM will gain additional revenue streams through the new interchain services offered, and liquid staking will roll out to increase capital efficiency for holders. The combined efforts here could be what it takes to solidify Cosmos as the top destination for app chain building, as big DeFi players like DyDx join the Cosmoverse.

Interchain Security

Security strength can be somewhat nebulous on Cosmos, with each independent chain relying on its own network of validators to execute transactions. With the way Tendermint consensus works, a chain becomes vulnerable if over 33.3% of validator voting power is used maliciously, so the smaller and more concentrated the validator set, the more vulnerable it is. This is mainly a concern for new chains, who must onboard reliable validators to run the network, referred to as “consumer chains” in the docs. The Interchain Security program, set to launch January ‘23 provides a path for new consumer chains to bootstrap a validator set through Cosmos Hub, eventually transitioning some of those shared validators out once the chain recruits enough of its own. This does limit the initial sovereignty of the app chain, but the buff to security seems worth it.

A percentage of the transaction fees generated by consumer chains will be shared between the IS validators and the Cosmos treasury, with the majority (~75%) going to validators. Consumer chains will also fork over some of their native tokens, which will end up being distributed to ATOM stakers. This aims to replace the inflationary ATOM emissions that have been previously used as staking rewards.

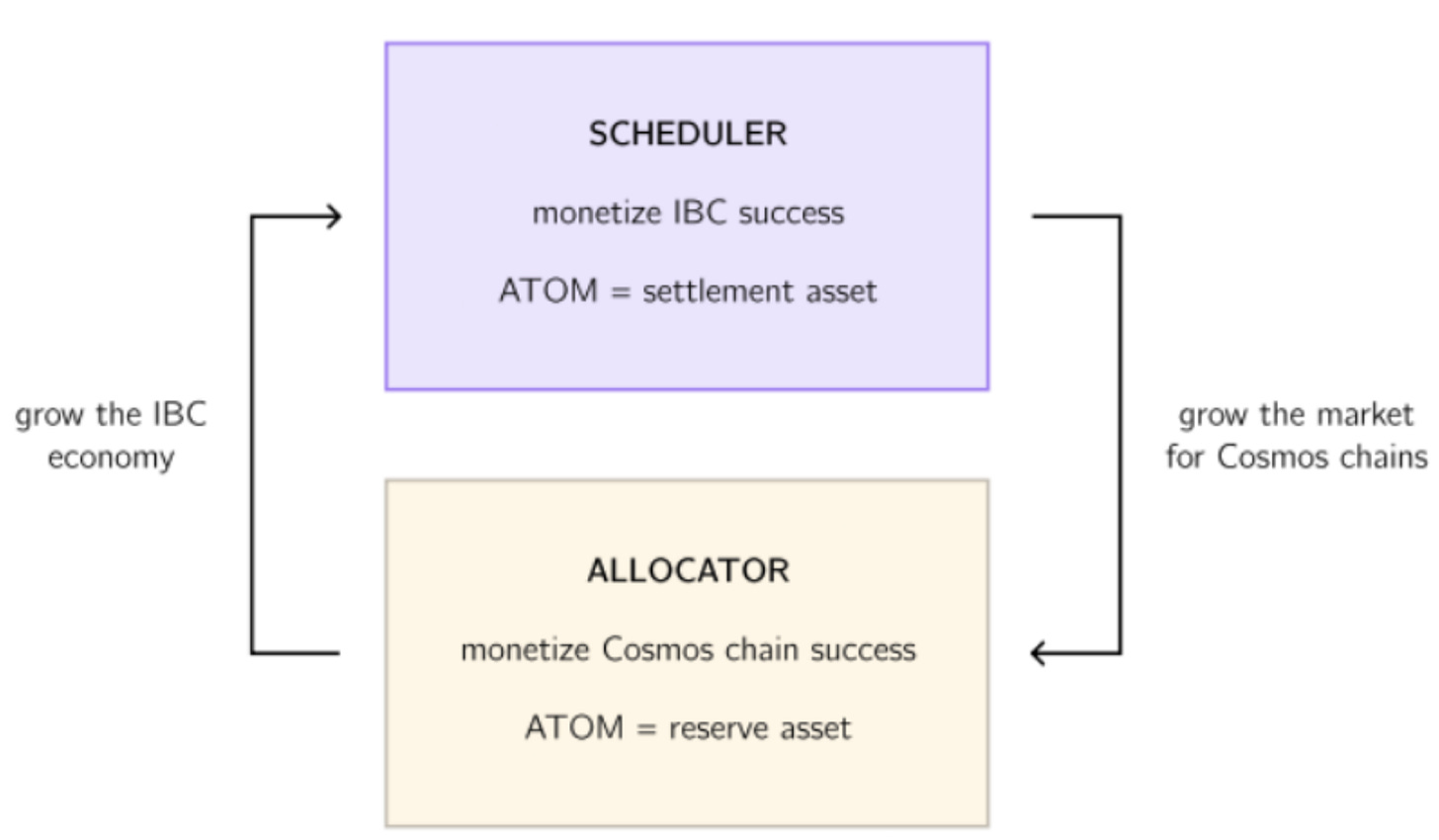

Interchain Scheduler and Allocator

The other side of the technical upgrades has to do with value capture, as Tendermint’s latest upgrade allows for separate transaction inclusion and ordering, opening up the door for an interchain transaction MEV marketplace. The new tool coming to Cosmos Hub for this purpose is the Interchain Scheduler, allowing the exchange of tokenized block space. Once a consumer chain turns on the Scheduler, it issues NFTs which work as reservations for future block space on that chain. These NFTs will be periodically issued and auctioned off to validators, allowing for more optimal use of block space in interchain transactions. ATOM of course will be the settlement asset for these block space purchases, continuing the 2.0 trend of enhancing its utility to drive demand.

Next, the Interchain Allocator comes into play as a method for Cosmos treasury management. As the scheduler brings in revenue through blockspace auctions, the allocator funds new and growing Cosmos projects, expanding the future market for interchain transactions.

How the Interchain Scheduler and Allocator work in a feedback loop to grow Cosmos- via whitepaper

ATOM 2.0

It’s no secret the near 13% annual inflation rate, and low value capturing potential of ATOM have hurt its performance as an asset. Thankfully this is being addressed, but rather than nuking the emissions rate immediately Cosmos is going for a soft landing of sorts. The new distribution schedule starts out with 10mm tokens per month, which is actually higher than the current scheme of 3.5mm per month, but this time the 10mm decreases by 12% each month until a steady state of 300k per month emissions is reached around Q3 2025. On the plus side this will eventually start pushing the inflation rate down to ~1% in the long run, but in the first 9 months of this program a ton of new ATOM will be flooding the market.

Comparison of ATOM emission schedules before/after 2.0 via whitepaper

The share of emissions going to validator rewards is taking a big hit, declining by 10% per month until the incentives end after 36 months. Validators will still be earning revenue from transaction fees, but the subsidies will be gone. Cosmos’ rationale here is that the increased revenues from shared security and interchain transactions will eventually surpass the old subsidy amount. The reality is that this won’t just happen overnight, which is likely why the new emissions schedule is so front-loaded, a move to retain validators while the new revenue streams are established.

The last important piece to mention about the new tokenomics is that Cosmos Hub is going to be more in control of ATOM flows in the future. The interchain initiatives will divert ~25% of the generated revenue to the treasury, and 5% of all new emissions are going to a community pool. The idea here is that giving the treasury some more influence over available supply will allow for a better balance to be maintained. Important note: if ATOM staking ratio falls below 66.7% the new emissions schedule reverts to the original schedule until the target ratio is met.

ATOM volume and price action chart via Messari

Is this the right strategy? In the long run it seems viable as ATOM inflation gets tamped down gradually, validator subsidies are phased out in favor of real revenue streams and utility for stakers, and the Cosmos Hub gains some influence over the balance of supply with demand. Ultimately the success is going to hinge on adoption for the new interchain tech being introduced, as those services’ usage will determine a sizable chunk of the demand for ATOM. Overall I’d say it's a step in the right direction, and has the distinct possibility of pushing up demand while slowing supply growth, a nice win for ATOM holders.

Liquid Staking

The final piece of the upgrade is Liquid Staking, a long awaited utility bonus for ATOM. Liquid staking allows for staked tokens to be used for other economic activity within the ecosystem, while still securing the chain. The new whitepaper states that infrastructure will soon become available for “premier vendors” to issue liquid staking tokens. It also mentions Interchain Security participants as the first to have liquid staking access, along with this graphic.

Interchain Security/Liquid Staking participants via 2.0 whitepaper

It follows that the entities in this graphic will be those “premier vendors” and ATOM holders delegating to them will be the first who are able to receive liquid assets representative of their staked position. This is a huge buff to ATOM capital efficiency, allowing stakers to participate in other protocols while still earning revenues from contributing to Interchain Security.

Governance

The governance process will also see some changes in 2.0 as the Interchain Security Counsel and Allocation DAO join the Consensus Council to make up the Cosmos Assembly. These three entities sit atop the hierarchy of Cosmos Governance, making decisions for treasury usage and growing the interchain ecosystem. The Cosmos SDK also includes a Governance Stack giving DAOs within the ecosystem a format and tools for organizing their own governance. The whole system is rather complex, but here’s a visual from the 2.0 whitepaper outlining what that governance model looks like for the Cosmos Assembly. The emphasis is on putting ATOM holders at the top of the hierarchy, another move to bolster the token’s value.

Governance model via 2.0 whitepaper

Future of App Chains

The basic thesis for Cosmos is that a growing number of new and existing protocols are going to prefer building on dedicated app chains. Does it make sense for every dapp out there to have its own chain though? Probably not, at least for the majority of niche DeFi products out there. Even with the tools Cosmos provides it’s still more involved than deploying on an existing chain like Ethereum or Solana. However, a nice stack of complementary dapps forming its own ecosystem on an independent chain, now that’s a solid use case. Again, think about how value leaks form a dapp to the chain it’s on, every transaction is going to incur fees and overall chain traffic can increase those costs. With an independent chain on Cosmos, a project with a suite of dapps can offer consistent low fees and an opportunity for users to take part in the fee earning through staking. Less leakage= more revenue for the ecosystem and less fees for users, win win.

Building Up The Ecosystem

Dydx is one of the biggest non Cosmos native protocols to go the app chain route, so looking at their reasoning can help envision the types of protocols that will adopt a similar strategy. Dydx listed decentralization and performance at scale as the top priorities in its decision making process. An independent Cosmos chain offers full sovereignty, especially as a large protocol that can bootstrap validators with relative ease, and high throughput, which is needed to maintain the off chain orderbook that powers trading. Beyond these factors the customizability lets Dydx deliver additional features like gas-less trades to users. Important to note here that Dydx publicized its upcoming move to app chain well before the whole Cosmos 2.0 announcement, which goes to show that Cosmos was still an attractive destination for DeFi innovators even before the upgrades.

Another notable addition to the ecosystem is Circle’s USDC, coming as a Cosmos native token in early 2023. Flawed as they are, centralized stablecoins are a huge part of crypto, and bringing USDC to Cosmos is a huge benefit to overall liquidity across the ecosystem. The announcement also floated the potential for Circle to utilize Interchain Security for validators, as it will be standing up a chain on Cosmos to issue USDC.

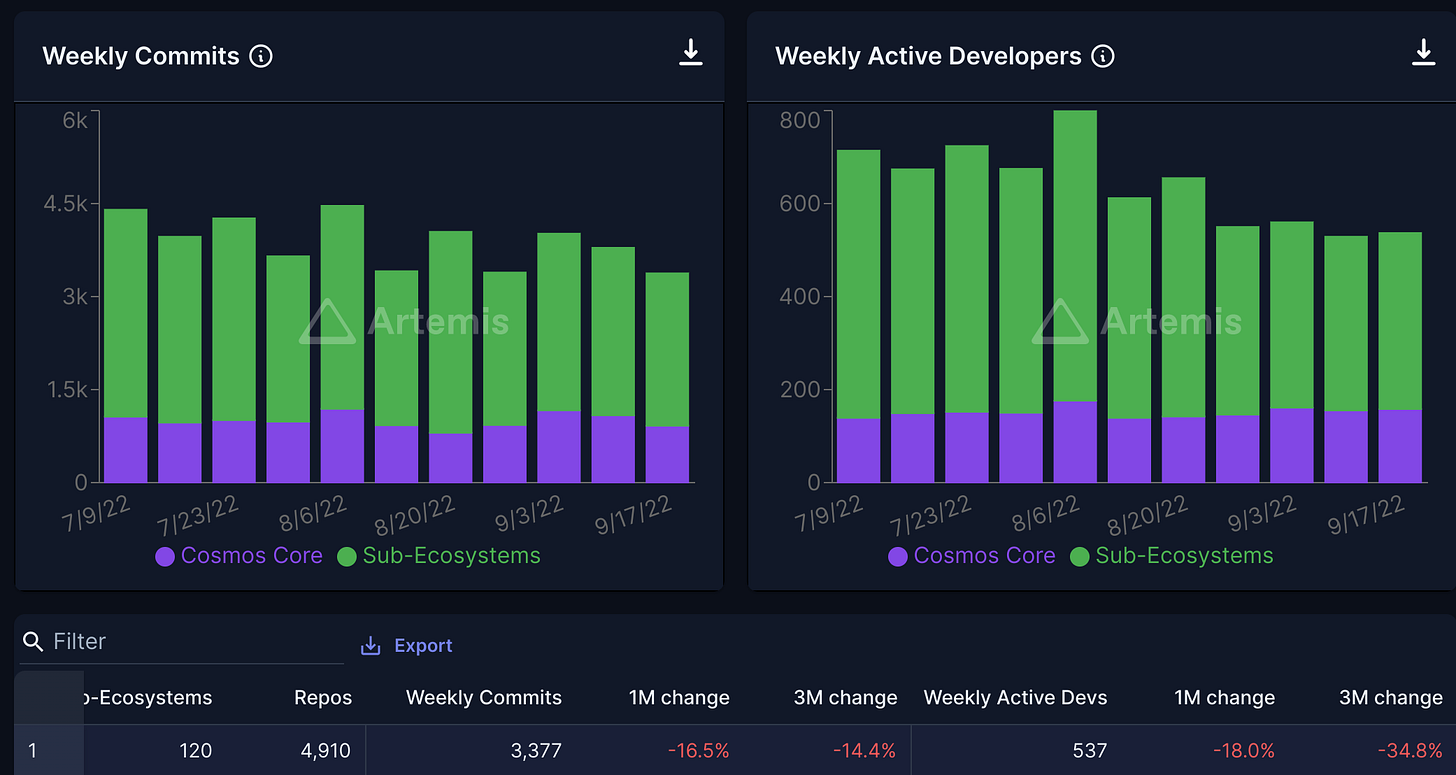

Overall developer activity on Cosmos has been down quite a bit over the last few months, no doubt somewhat due to poor general market conditions. I figure development overhead is another factor here, as bootstrapping validators presents a significant barrier to new builders. Being that 2.0 aims to resolve this issue with Interchain Security, looking at developer activity closer to its January 2023 launch could be a valuable leading indicator for ATOM. More new chains will mean more usage of Interchain Security validator services, leading to increased revenue for stakers/ delegators.

Cosmos dev stats via Gokustats.xyz

Summary

All things considered, the new components being introduced in Cosmos 2.0 work well together, increasing the utility of ATOM and strengthening the ties between ecosystem chains. The reworked tokenomics are long term bullish, and were much needed as the current inflationary system disincentivized long term holding. The ultimate success of 2.0 comes down to adding more chains into the ecosystem, which will grow the revenues generated by the new interchain services offered via Cosmos Hub. Dydx and USDC coming to Cosmos is a great start, so keep an eye on developer activity and potential announcements of other protocols migrating to Cosmos for an indication of future success.

love this!